are closed end funds riskier

The longer you plan on staying invested the longer you have to make up for. Closed-end funds are a type of investment company whose shares are traded in the open market like a stock or ETF.

7 Best Closed End Funds Of 2021

The key difference between a closed-end fund and an open-end fund such as a mutual fund or.

. Closed end funds issue a set number of shares at the funds origin that trade on the stock exchange. Capital does not flow into or out of the funds when shareholders buy or sell. Closed-end funds are funds that have a set number of shares to trade.

When investors buy or sell shares no new shares are issued. C Arbitrage The notion that holding a closed end fund is riskier than holding from FINA 4325 at University of Minnesota-Twin Cities. Certain closed-end funds may invest without limitation in illiquid or less liquid investments or investments in which no secondary market is readily available or which are otherwise illiquid.

Closed-end assets are riskier than open-end assets which is fine for those with a long time horizon. Open-end funds such as mutual funds or ETFs take in money from new investors issue additional. A closed-end fund is a type of mutual fund that issues a fixed number of shares through a single initial public offering IPO to raise capital for its initial investments.

Plus closed-end funds that return capital can carry a higher level of risk because the asset base needed to generate income to pay future distributions is being eroded. Its assets are actively managed by the funds. Closed-end funds CEFs totaled 275 billion in assets at the end of 2017 compared to 187 trillion for the mutual fund industry as a whole according to the Investment.

Puerto Rico Investors who purchased UBS Puerto Rico closed-end funds may have experienced a dramatic unexpected drop in the value of their accounts. The Closed-End Fund Structure Has Significant Advantages CEFs have a superior wrapper that helps to provide some advantages to the holder if they can be taught how to. Generally theyre no riskier than their cousins open-ended mutual funds.

A closed-end fund is a type of investment vehicle thats similar to a mutual fund. A closed-end fund is a type of investment company whose shares are traded on a stock exchange or in the over-the-counter market. There are many different ways we can measure that risk.

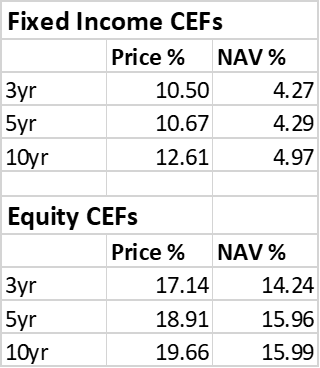

A closed-end fund is the result of an. In parts I and II here and here we discussed the various concepts of risk as it pertains to closed-end funds CEFs. Closed-end funds CEFs are actively managed registered investment vehicles that pool the money of many investors to buy baskets of securities providing access to.

A closed-end fund is not a traditional mutual fund or exchange-traded fund.

7 Worst Buys In Closed End Funds

Why Closed End Mutual Fund Schemes Are A Risky Investment The Economic Times

5 Best High Yielding Closed End Funds To Buy

5 Best High Yielding Closed End Funds To Buy

Why Are Yield Starved Investors Ignoring Closed End Funds Relative Value Partners

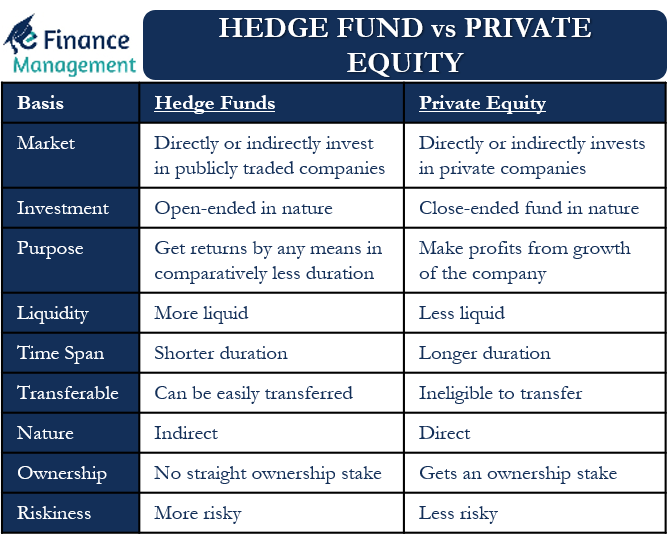

Hedge Fund Vs Private Equity Meaning Differences And More Efm

Just How Risky Are Cefs When Building A 8 10 Portfolio Yield Part Iii Seeking Alpha

How To Measure Closed End Fund Risk Nyse Nmz Seeking Alpha

Investor Sentiment And The Closed End Fund Puzzle Lee 1991 The Journal Of Finance Wiley Online Library

Etf Vs Mutual Fund What S The Difference Ally

5 Best High Yielding Closed End Funds To Buy

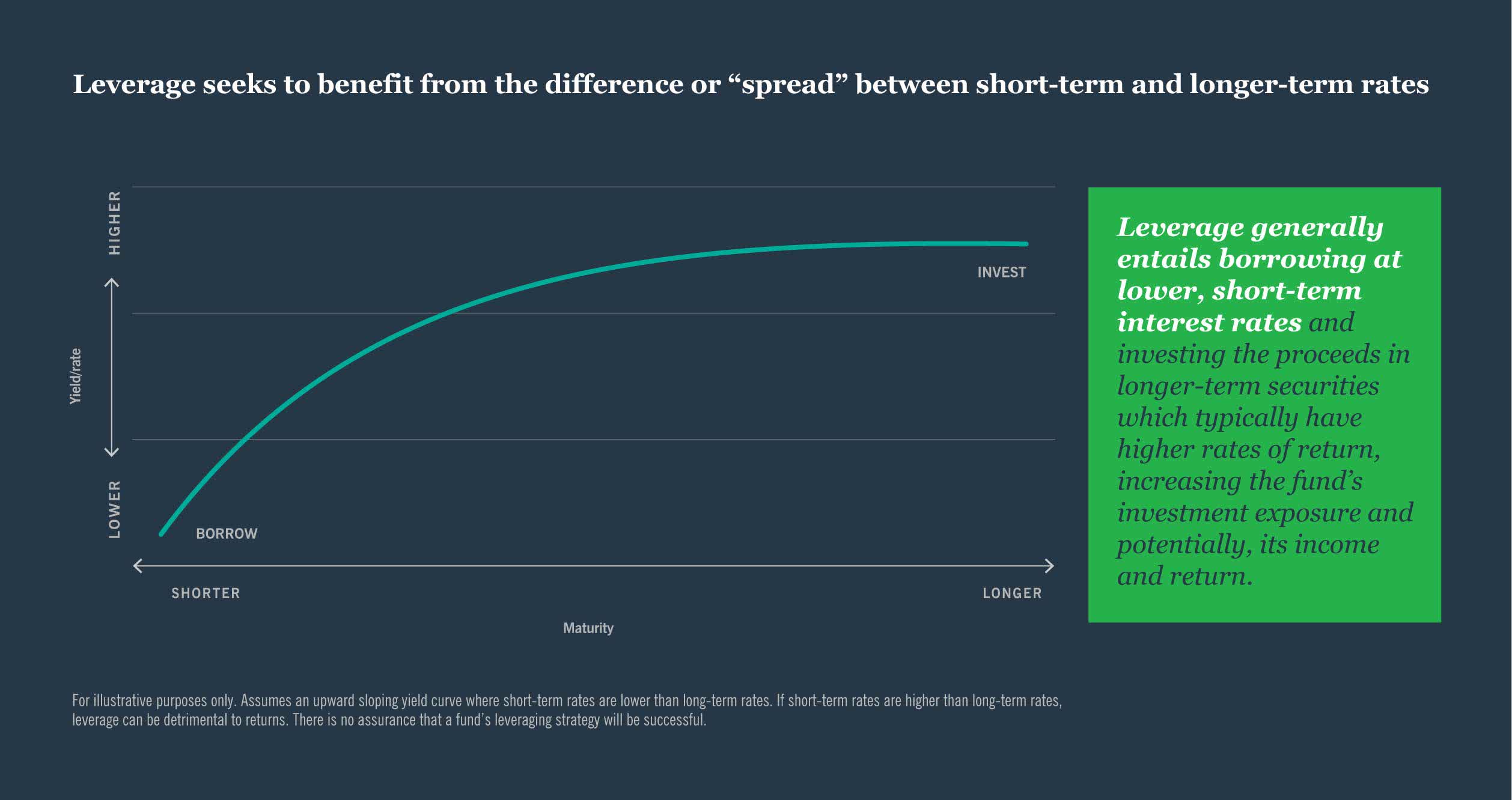

Understanding Closed End Fund Structures Nuveen

Why Closed End Mutual Fund Schemes Are A Risky Investment The Economic Times

5 Reasons To Use Closed End Funds In Your Portfolio Blackrock

Making Sense Of Closed End Funds Barron S

Do Closed End Funds Belong In Your Portfolio Everyincome Library

Just How Risky Are Cefs When Building A 8 10 Portfolio Yield Part Iii Seeking Alpha